The Silent Saboteur: How One Unseen IT Flaw Could Cost You More Than Just Clients

Let me tell you a story. A few years back, a boutique financial advisory firm—three partners, one assistant, and a whole lot of trust riding on their reputation—called me in a panic. Their network had gone down. Nothing major at first. Just a glitch, they said. But by the time they’d figured out it wasn’t […]

Training Employees to Spot Social Engineering

Social engineering is one of the newest methods hackers use to access sensitive information. Rather than attacking a system directly, this technique relies on human psychology to gain information. This method is brilliant when you think about it because it does not have to deal with going past ironclad network security. If hackers can manipulate […]

Top 8 Phishing Scam Tactics and How to Identify Them

Phishing has been a common hacking method for over two decades now. You would think that everyone would already know how it works and how to avoid becoming a victim, right? Sadly, that is not the case for these Phishing Scam Tactics. There are more victims now than ever. In 2022, there were more than […]

The Top 7 Mobile Security Threats to Address in Your BYOD Policy

BYOD or Bring Your Own Device is a modern practice where employees use their personally owned gadgets – smartphones, laptops, tablets, or whatnot – for work. This is opposed to the traditional method of using company-issued equipment exclusively for work stuff which can have mobile security threats. The BYOD policy has several perks, such as […]

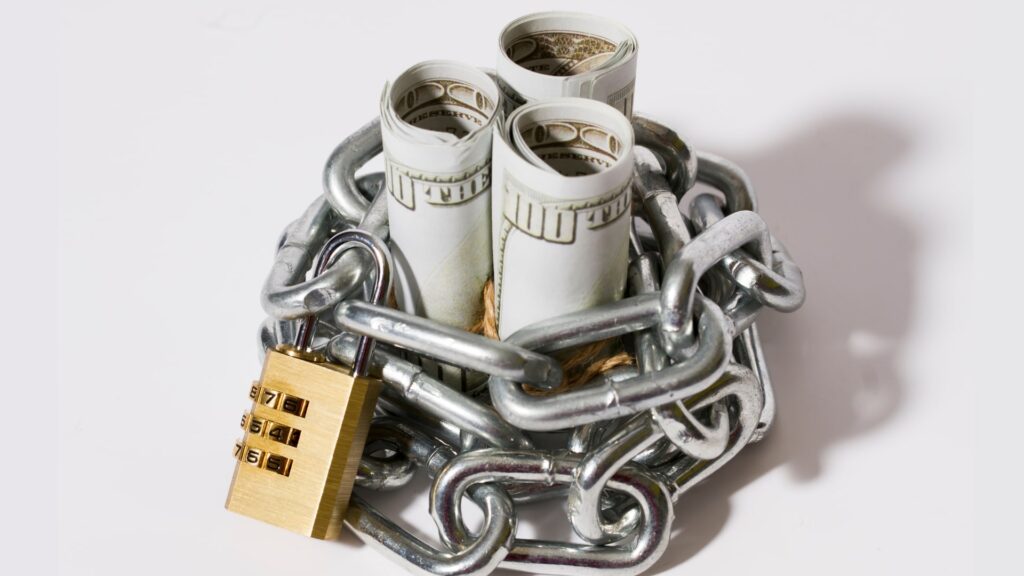

Why Cybersecurity Insurance Matters

As businesses move forward into a digital environment, cybersecurity insurance becomes even more crucial as online threats grow more advanced. Before, hackers only targeted large, high-revenue corporations since they had the money and the valuable information. But statistics show that over 40% of recent cyberattacks target small businesses. But what’s even more alarming is that […]

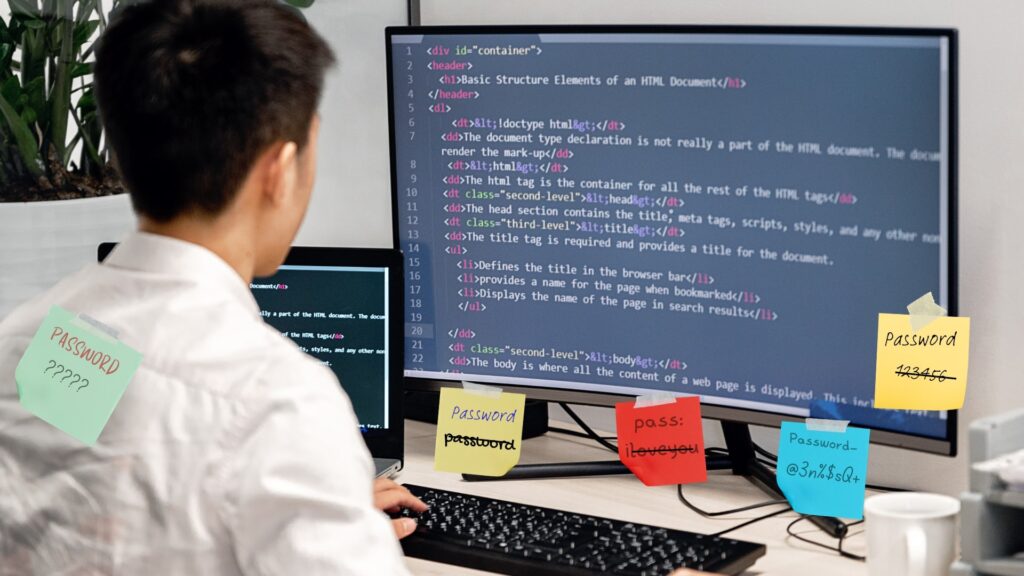

10 Reasons Why Businesses Need Password Management

Password security is one of the most basic yet valuable aspects of protecting your business. Your company’s security relies heavily on the quality of your passwords and how you manage them. Therefore, people must choose strong, unique passwords and regularly change them to minimize the risk of hacking. That is why businesses need to choose […]

Why Are Managing Passwords So Hard?

We do most of our business online—emailing, shopping, banking, and much more. But before you take any action, you must log in with a name and password. It’s pretty routine, but with the rapidly growing number of online services that require passwords, it can get increasingly difficult when we are managing these passwords. Managing Passwords […]

Best Password Management for Businesses

The best password management is important for businesses. If your passwords are weak or not stored in a safe location, hackers can easily penetrate your system, causing a myriad of damage to the company, your clients, your customers, and who knows what else. You don’t want that to happen! Fortunately, there are now a lot […]

Why Businesses Need Password Management

As digital technology becomes more advanced, so do the risks of online security breaches. Cyberattacks continue to be a problem, so businesses need to implement reliable security measures now more than ever. There are many security solutions available. One of the simplest yet most effective is a first-rate password management solution. What Is Password Management? […]

10 Reasons Why Businesses Need a Digital Estate Plan

In the last two weeks, we have talked about digital estate plans and why it is crucial for businesses today to have one. Since most business data is now stored digitally, it makes sense to protect these digital assets in the event the business owner passes away. If you still don’t have one and are […]